Dive into the world of physical Bitcoin ETFs with Pantera Capital's insightful views. Discover how their strategy of "buy the rumor, and buy the news" differs from traditional market wisdom.

Learn about the historical effectiveness of this approach and why Pantera Capital believes the physical Bitcoin ETF could fundamentally change the Bitcoin market.

Contents

Pantera Capital's Stance on the Much-Anticipated Physical Bitcoin ETF

In the cryptocurrency industry, the anticipated physical Bitcoin ETF has garnered attention with opinions supporting the adage "buy the rumor, sell the news."

However, in an article published on November 15, 2023, the U.S. cryptocurrency hedge fund Pantera Capital has diverged, stating "buy the rumor, and buy the news too."

Historical Instances of "Buy the Rumor, Sell the News" in Cryptocurrency

"Buy the rumor, sell the news" is a renowned adage and investment strategy known in various markets, including cryptocurrencies.

It refers to buying when rumors of positive news surface and selling when the news becomes a fact. Pantera Capital acknowledges in their recent article that this strategy worked perfectly in two past instances.

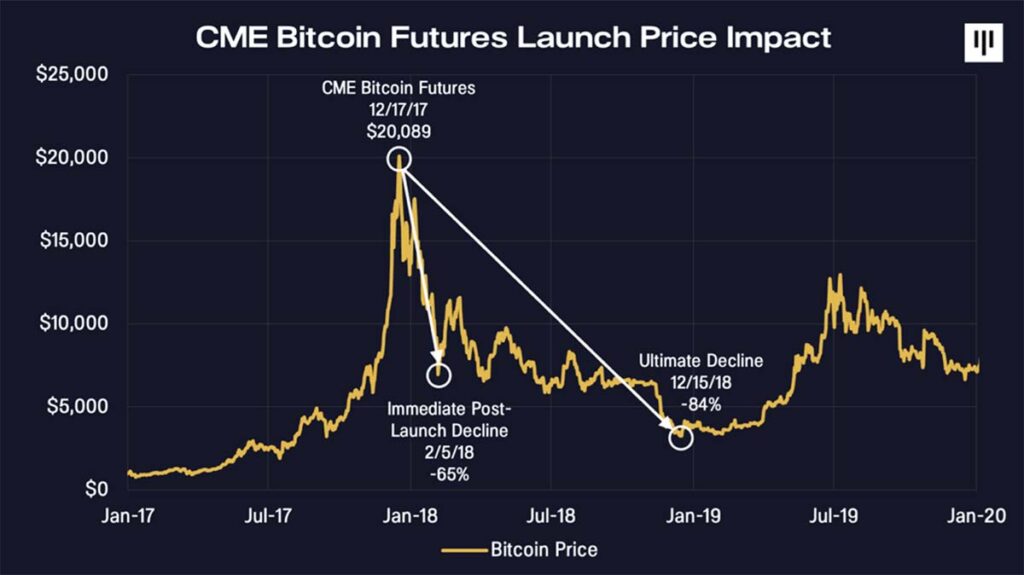

They report that "at the launch of CME Bitcoin futures, the price soared by 2,448% until the listing day, followed by a bearish trend of -84% starting from that day."

The second instance was during the Coinbase listing, where "there was an 848% rise prior to the listing, and Bitcoin's price peaked at $64,863 on the listing day, followed by a -76% bear market."

Is the Physical Bitcoin ETF a Different Scenario?

The physical Bitcoin ETF, awaiting approval from the U.S. Securities and Exchange Commission (SEC), has seen heightened anticipation, with significant price increases in Bitcoin and other cryptocurrencies.

Despite opinions suggesting a potential price crash upon the actual approval of the physical Bitcoin ETF, Pantera Capital posits that "the movement for the physical Bitcoin ETF might be different from previous patterns."

They assert that "BlackRock’s physical ETF will fundamentally change access to Bitcoin," and "the impact of BlackRock’s physical ETF will be significantly positive."

They emphasize that "ETFs are a critical step towards becoming a major asset class" and explain, "having an ETF means effectively being short if you don't have exposure. Buy the rumor and buy the news."

Pantera Capital also strongly believes that many Bitcoin ETFs will be approved soon, not years later, but in "about one to two months."

-

Will Bitcoin Crash Before the Launch of a Physical ETF? Predictions by Peter Schiff

Explore the varied predictions on Bitcoin's future, including a potential crash before the physical ETF launch and soaring valuations post-halving.

続きを見る